schedule c tax form meaning

An activity qualifies as a business if. What is a Schedule C.

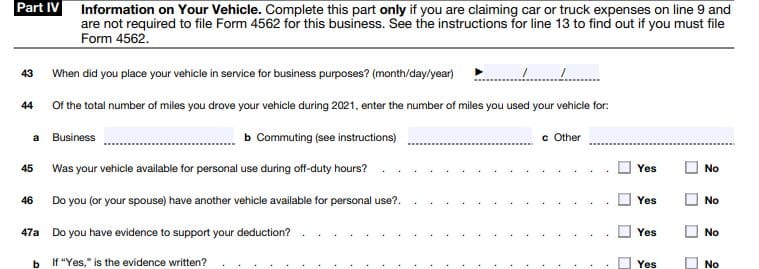

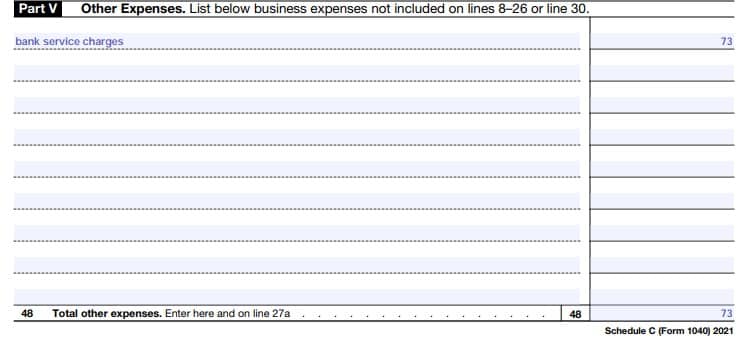

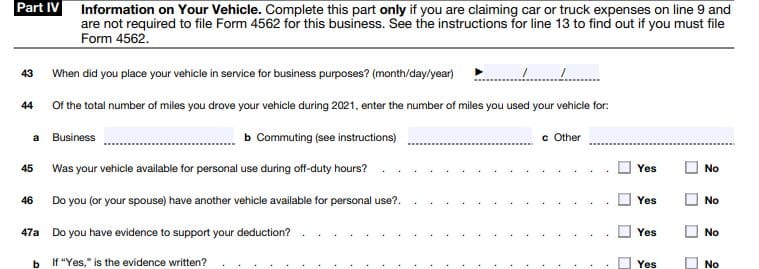

How To Fill Out Your 2021 Schedule C With Example

If you receive a Form 1099-MISC 1099-NEC andor 1099-K you are likely to have to report it on Schedule C along with other.

. You may not have created a business but if you are working as a contract employee a consultant a self-employed individual etc Schedule C is used to report the income and loss and calculate your Self-Employment tax. You are involved in the activity with continuity and regularity. It calculates your businesss net.

The last line in this form called Net Income is going to be the only number off that Schedule C that gets transferred onto your 1040 form. If you do any freelancing or work as an independent contractor you will use Schedule C to record your net. Its used to report profit or loss and to include this information in the owners personal tax returns for the year.

Besides sole proprietorships three other types of business may use Schedule C. In 2018 the last year reported more than 27 million small business owners filed their tax returns using Schedule C. Usually if you fill out Schedule C youll also have to fill out Schedule SE Self-Employment Tax.

You must use the same accounting method from year to year. The Schedule C tax form combines a sole proprietors business income and expenses to determine the net profit reported on Form 1040. Ad Access IRS Tax Forms.

Complete Edit or Print Tax Forms Instantly. The resulting profit or loss is typically considered self-employment income. A Schedule C form is a detailed form as figures for income expenses and cost of goods sold all need to be recorded.

An accounting method is the method used to determine when you report income and expenses on your return. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This can encompass owning a digital or brick-and-mortar small business freelancing contracting and gig work such as ride-share driving.

Schedule C is the form used to report income and expenses from self-employment. The Net Income is the income your entrepreneurial activity. You might be thinking of Schedule C as Schedule C taxes but the full name of the form is Schedule C.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C is an important tax form for sole proprietors and other self-employed business owners. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business.

Profit or Loss From Business Sole Proprietorship. The IRS disregards an LLC with only one membercalled an. The Schedule C tax form Profit or Loss From Business was created by the IRS for anyone who earns money as a sole proprietor or single-member LLC.

The 1040 Schedule C tax form is a tool for sole proprietors to ensure they dont pay too much or too little in taxes. The Schedule C form is designed to let sole proprietors write off as much of their expenses as possible from their tax bill in hopes. Schedule C is used to report income or loss from a business you operated as a sole proprietor.

A net profit or loss figure will then be calculated and then used on the proprietors personal income tax return on form 1040. You can use Schedule B with Forms 1040. Who Files a Schedule C Tax Form.

Its one of those tax forms that does exactly what its name says. A Schedule C form is a detailed form as figures for income expenses and cost of goods sold all need to be recorded. If you wish to change your accounting method you need permission from the IRS.

An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. It is a form that sole proprietors single owners of businesses must fill out in the United States when filing their annual tax returns. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Complete Edit or Print Tax Forms Instantly. Its important to note that this form is only necessary for people who have had income reported on 1099 forms meaning they are considered contract employees rather than full employees of the company or organization contracting them. However preparation of the schedule is only necessary when your interest or dividend income exceeds the IRS threshold for the year - 1500 in 2021.

Schedule C - Accounting Method. Ad Access IRS Tax Forms. All of your business income all of your business expenses are reported onto this Schedule C form.

Schedule B is an income schedule that requires you to separately list the sources of interest and dividend payments you receive during the year. Schedule C is an IRS form that self-employed people use to report profit or loss from their business. An accounting method is chosen when you file your first tax return.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. The Schedule C tax form is used to report profit or loss from a business. Typically a sole proprietor files their personal and business income taxes together on one return.

A Schedule C form is a tax document filed by independent workers in order to report their business earnings. Your primary purpose for engaging in the activity is for income or profit. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Your 1040 is your individual tax return. The form considers the income they make along with the expenses that it took to make that income.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

How To Fill Out Your 2021 Schedule C With Example

Business Activity Code For Taxes Fundsnet

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

Business Activity Code For Taxes Fundsnet

/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Business Activity Code For Taxes Fundsnet

How To Fill Out Your 2021 Schedule C With Example

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

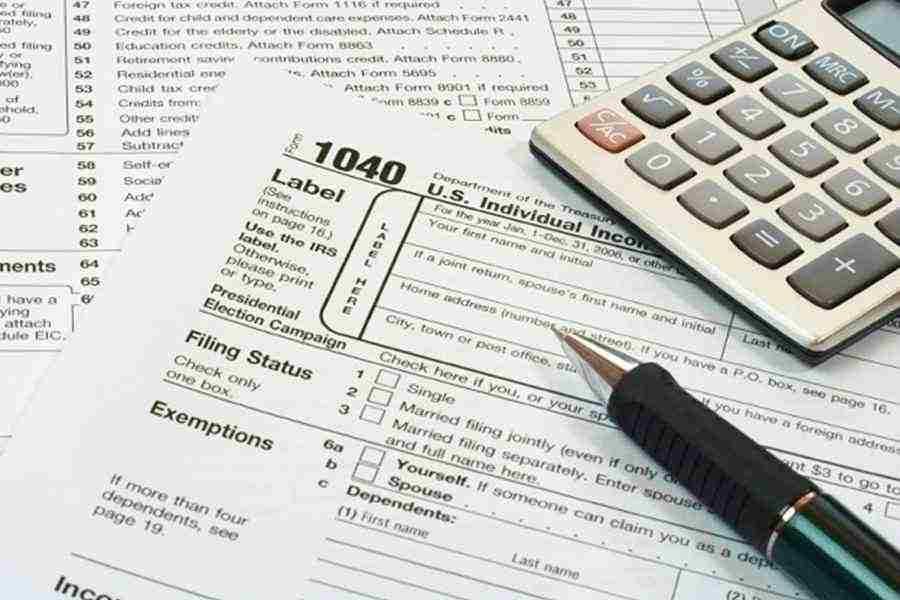

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

How To Fill Out Your 2021 Schedule C With Example

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

What Do The Expense Entries On The Schedule C Mean Support

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

Form 11 Schedule C Seven Outrageous Ideas For Your Form 11 Schedule C Tax Forms Federal Income Tax Schedule

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)